Qualified

Member of the Chartered Insurance Institute and Personal Finance Society. Level 4 qualified in multiple disciplines.

Regulated

Licensed and regulated under the European Markets in Financial Instruments Directive II (MiFID II)

Trusted advice

Helping 100s of families achieve second citizenship and managing €10m+ of their assets

Qualified (UK standards)

Regulated

Trusted advice

Residency & Citizenship by Investment (Golden Visas)

Golden Visas, or Residency by Investment programs, have never been more popular. By investing in a country, you can access a variety of benefits. This may include visa-free travel, a Plan B place to live, second citizenship, the right to live/work/retire where you choose… and many more.

Residency rights

Whether you need a Plan B escape route from your home country, or would simply like to relocate in the future.

Second citizenships

Get full citizenship rights. Visa-free travel, access to healthcare and the right to build a new life wherever you choose.

For the whole family

Second citizenship rights that are passed down to all generations to come. Build a brighter future for your family.

Financial Planning

Select a country above to learn more about the key financial planning issues to bear in mind as an expat.

Alternatively, book a free financial review with Jonathan for tailored advice on your situation.

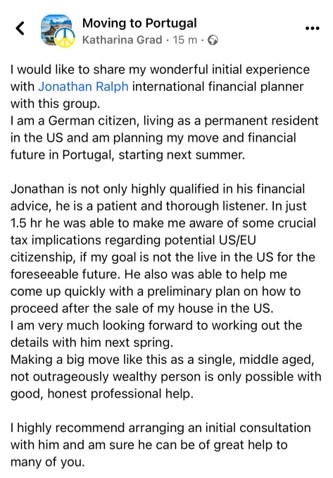

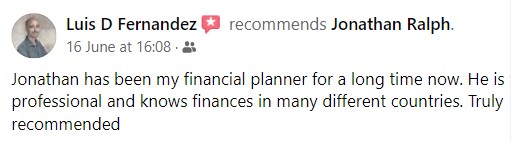

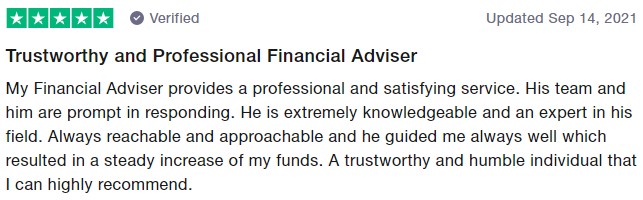

What our clients say:

Reaching your goals together in 3 simple steps:

The consultation

Our first meeting will focus on gathering the necessary information to build your financial plan. We’ll discuss your current situation and your goals for the future. After the meeting, we’ll analyse the most suitable options for you and begin preparing a financial plan.

The financial plan

Next, we will send you through a detailed document outlining our recommendations. When you are ready, we will hold a second meeting to present, discuss and adapt these recommendations to ensure the plan meets your needs.

The implementation

Once we have agreed the plan, we will implement it as soon as possible to ensure your affairs are in order. We will keep you informed of the progress at every step of the way, and commit to being available to help with any further queries you may have.

We’ll then review your progress together (quarterly, annually or as appropriate) to ensure you’re on track to hit your financial planning targets, and make adjustments to your strategy as your situation changes.

Free financial planning guides and webinars

Key information to start adapting your finances for life overseas.

Holistic financial planning

We often find that clients come to our first meeting with a certain objective in mind, but leave with several more. This is because we take a global view of your financial situation, looking to optimise your wealth management strategy wherever possible. Our holistic approach ensures you are growing and protecting your wealth in an efficient way, with no blind spots.

As our relationship develops over time, your goals will also likely evolve. By taking a comprehensive view of your finances, we can build and adapt the appropriate financial planning strategy that looks after your needs – for life.

Here when you need us.

Online and in person

We understand the challenges of expat life, and the importance of having a support network around us. Whilst we will be available for face-to-face meetings for normal business, there may be times where more urgent support is required.

Thanks to modern technology, we are also able to offer confidential online support. This means that we can be with you via videoconference, calls and instant messaging – wherever you are, whenever you need us.

Expert advice is just a click away.

What we do

Estate planning

Intelligent planning around your inheritance tax position, to ensure your family can keep as much of your legacy as possible.

Investment planning

Bespoke wealth management services to grow your assets, generate additional income and allow you to meet your lifestyle goals.

Tax planning

Optimising your tax position so you can keep as much of your wealth as possible. Essential for expats unfamiliar with local tax laws.

Pensions & Retirement

UK expats have access to a range of potentially beneficial pension arrangements, including QROPS and SIPPs.

Passports & Golden Visas

Acquire second citizenship via a property investment. Fully managed service with rental income and buyback guarantees.

Property Investments

Acquire high-yield investment property at unbeatable prices. Exclusive UK & EU opportunities with vetted developers.

A lasting relationship that works for you

We don’t hide behind corporate structures and impersonal brands.

We trade under my own name to reflect our values of transparency and honesty.

Our aim is to build a lasting relationship together – guiding you towards financial success and the lifestyle you deserve. We are partners in your quality of life, and will be here for you when you need us. Whether you need expat financial planning, golden visas, second citizenships or general investment advice, we will offer a tried and trusted solution.

This is expat financial advice that you can trust.

Here’s to your future!